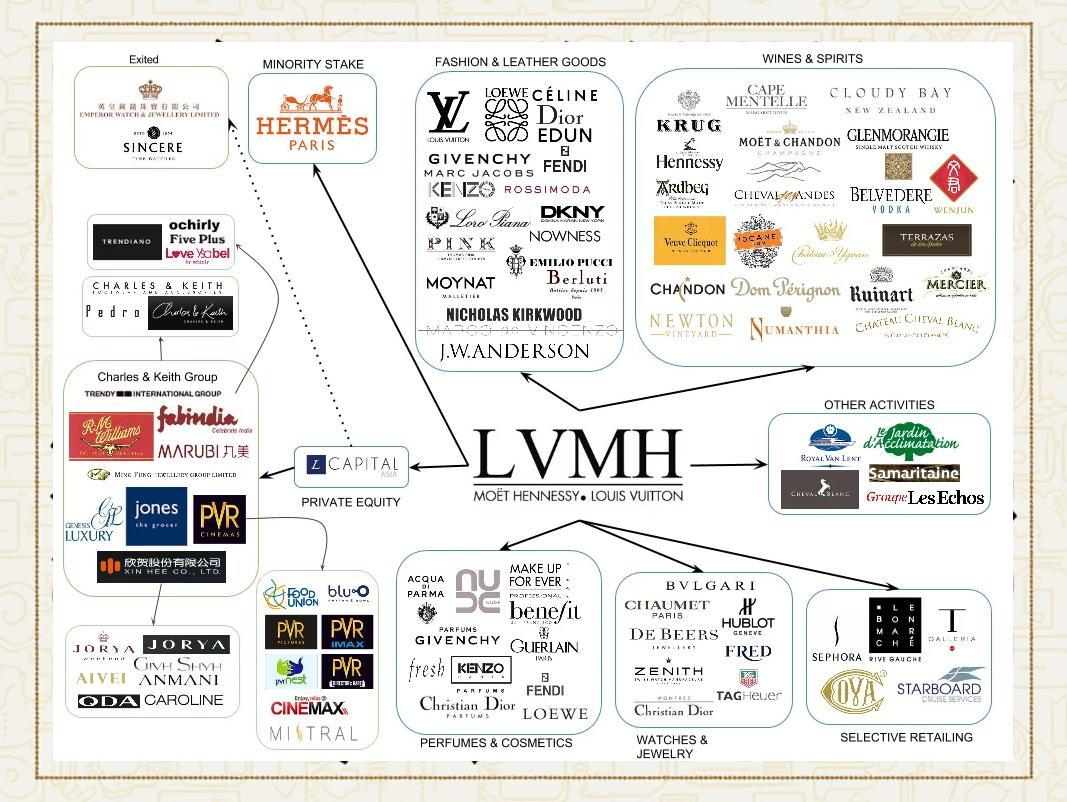

In recent years, the acquisition amounts of LVMH Group have experienced explosive growth. From Dior to Tiffany, each acquisition has involved transactions worth billions of dollars. This acquisition frenzy not only demonstrates LVMH's dominance in the luxury market but also fuels anticipation for its future moves. LVMH's acquisition strategy is not merely about capital operations; it is a core mechanism for expanding its global luxury empire. Through these acquisitions, LVMH has not only solidified its leadership in traditional luxury sectors but also continuously explored new market territories, further enhancing its brand diversity and global influence.

2015: Repossi

In 2015, LVMH acquired a 41.7% stake in the Italian jewelry brand Repossi, later increasing its ownership to 69%. Founded in 1920, Repossi is renowned for its minimalist designs and innovative craftsmanship, particularly in the high-end jewelry segment. This move underscored LVMH's ambitions in the jewelry sector and infused new design philosophies and brand vitality into its portfolio. Through Repossi, LVMH further consolidated its diversified presence in the jewelry market, complementing its existing brands such as Bulgari and Tiffany & Co.

2016: Rimowa

In 2016, LVMH acquired an 80% stake in the German luggage brand Rimowa for €640 million. Established in 1898, Rimowa is celebrated for its iconic aluminum suitcases and innovative designs, making it a leader in the premium travel goods market. This transaction not only reinforced LVMH's position in the high-end travel accessories sector but also provided a new growth avenue in the lifestyle segment. Rimowa's inclusion enabled LVMH to better cater to the demands of global luxury consumers for travel products, further enhancing its comprehensive competitiveness in the luxury market.

2017: Christian Dior

In 2017, LVMH acquired full ownership of Christian Dior for $13.1 billion, integrating the brand entirely into its portfolio. As a quintessential French luxury brand, Christian Dior has been a benchmark in the fashion industry since its founding in 1947. This acquisition not only solidified LVMH's position in the luxury market but also strengthened its influence in high-end fashion, leather goods, and fragrances. By leveraging Dior's resources, LVMH was able to amplify its brand image globally and further expand its market share.

2018: Jean Patou

In 2018, LVMH acquired the French haute couture brand Jean Patou. Founded in 1912, Jean Patou is renowned for its elegant designs and exquisite craftsmanship, particularly in the haute couture segment. This acquisition further extended LVMH's influence in the fashion industry, especially in the high-end couture market. Through Jean Patou, LVMH not only attracted more high-net-worth clients but also elevated its reputation and standing in the fashion world.

2019: Fenty

In 2019, LVMH partnered with global music icon Rihanna, acquiring a 49.99% stake in her Fenty brand. Fenty, a fashion brand founded by Rihanna, is celebrated for its diversity and inclusivity, particularly in the beauty and fashion sectors. This collaboration not only merged music with fashion but also infused LVMH with fresh brand energy and access to a younger consumer base. Through Fenty, LVMH expanded its reach among younger demographics and strengthened its competitiveness in diverse markets.

2019: Stella McCartney

In the same year, LVMH entered into a joint venture with British designer Stella McCartney. Known for her commitment to eco-friendly and sustainable fashion, Stella McCartney is a pioneer in sustainable fashion. This partnership not only aligned fashion with sustainability but also set a new benchmark for LVMH in the sustainability arena. Through Stella McCartney, LVMH attracted environmentally conscious consumers and bolstered its reputation and influence in sustainable development.

2020: Tiffany & Co.

In 2020, LVMH acquired the American jewelry brand Tiffany & Co. for $15.8 billion. Established in 1837, Tiffany is one of the world's most iconic jewelry brands, celebrated for its signature blue boxes and high-end jewelry designs. This acquisition not only reinforced LVMH's position in the jewelry market but also provided robust brand support for its global jewelry operations. Through Tiffany, LVMH expanded its footprint in the North American market and solidified its leadership in the global jewelry sector.

LVMH Group's Ambitions and Future Prospects

Through these acquisitions, LVMH Group has not only expanded its market share in the luxury sector but also laid a solid foundation for its future growth. LVMH's acquisition strategy is not merely about capital operations; it is a core mechanism for expanding its global luxury empire. By acquiring and integrating brands, LVMH has not only reinforced its leadership in traditional luxury markets but also continuously explored new territories, further enhancing its brand diversity and global influence.

LVMH's ambitions extend beyond the existing luxury market, aiming to explore new sectors through acquisitions and innovations. For instance, collaborations with Rihanna and Stella McCartney have enabled LVMH to attract younger consumers and set new standards in sustainable fashion. In the future, LVMH is likely to continue its expansion through acquisitions and partnerships, further strengthening its influence in beauty, lifestyle, and sustainability, thereby cementing its position as a global luxury empire.

(Imgs from Google)

Recommend For You

- Tiffany & Co.’s 2025 ‘Bird on a Pearl’ High Jewelry Collection: A Timeless Symphony of Nature and Art

- Embrace Wisdom and Strength: Bulgari Serpenti Jewelry for the Year of the Snake

- Van Cleef & Arpels Presents: Treasure Island – A Dazzling Voyage Through High Jewelry Adventure

- Dior Fine Jewelry: The Art of Nature

Post time: Mar-03-2025